Frequently Asked Questions

- Home

- Frequently Asked Questions

What is the meaning of the "Vacant area"?

"Vacant Land" means the land where there are no functional ports, manufacturing units, industrial activities or structures in which any commercial or economic activity is in progress. (Rule 2 (zf)).

What is meant by contiguous area? Can an underpass/over bridge to connect two pieces of land separated by road/canal etc. create contiguity?

Contiguous area means 'an area which is connecting without a break, within a common boundary'. Fulfillment of the requirement of contiguous area in respect of SEZs shall be considered by the Board of Approval on a case-to-case basis, in case the contiguity is broken due to existing roads, railwaylines, streams etc. (Rule 7(2))

The conditions for relaxation of contiguity criteria in respect of multi-product SEZs are as under (Instruction No:27 of Department of Commerce):-

i) The developer shall maintain contiguity by dedicated security gates/overbridges/underpass/culverts and also fence side of the road facing the processing area.

ii) No tax benefits would be available for measures taken to establish contiguity.

iii) The entire processing area would be located on one side of the National Highway.

iv) The formal approval from authorities concerned like NHAI and others would be submitted to the Department of Commerce and work for establishing contiguity would be started only after obtaining the requisite approvals.

v) No LoA for any SEZ unit will be issued till the entire measures to establish contiguity and securitization of the processing area are completed.

vi) the movement shall be restricted between the two SEZs till contiguity is established and the present systems will continue

What is the processing and non-processing area? Who is the authority to demarcate the processing and non-processing area?

The processing area is that area in an SEZ where units can be located for manufacture of goods or rendering of services. The Free Trade and Warehousing Zone can also be set up only in the processing area of a multi product SEZ.

The processing and non-processing areas will be demarcated by the Development Commissioner. The processing area and Free Trade and Warehousing Zone shall have specified entry and exit points and be fully secured by taking such measures as approved by the Board of Approval. The non-processing area is the area which is intended to provide support facilities to the SEZ processing area activities and may include commercial and social infrastructure. (Section 6 of SEZ Act and Rule 11)

In this context, the Board decided to prescribe the following norms for boundary walls (Instruction No. 25 of Department of Commerce):

A. In respect of IT/ITES SEZs, the height of the wall will be decided by the DC

B. In respect of other SEZs, the wall could either be 2.4 meters in height or 1.8 meters in height plus 0.6 meters of barbed wire fencing.

C. For any deviations, the proposals can be referred to BoA for a decision.

(Instruction No. 25 of Department of Commerce)

What are the incentives and facilities available to the developers of SEZs?

The major incentives and facilities available to SEZ developers include:-

• Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BOA.

• Income Tax exemption for a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. Block of 10 years will be selected at the discretion of the developer.

• Exemption from minimum alternate tax under Section 115 JB of the Income Tax Act.

• Exemption from dividend distribution tax under Section 115 O of the Income Tax Act.

• Exemption from Central Sales Tax (CST) for authorised operations.

• Exemption from Service Tax. (Section 7,26 and Second Schedule of the SEZ Act) for authorised operations.

What are the steps involved in establishment of a Special Economic Zone?

The steps involved are:

• A developer intending to set up an SEZ should first identify the category of SEZ he intends to apply for.

• Area for setting up of the SEZ needs to be identified. (The area should not be less than the minimum area indicated at Q.2 above.)

• After identifying the area, an application for establishment

of SEZ in Form - A is to be made to the State Government concerned. (Rule 3). If the land is owned by the Developer or has already been leased for a period in excess of 20 years by the Developer, the details of the same can also be filed alongwith the application.

• The State Government, at the time of recommending the proposal, shall commit to provide the facilities and incentives such as exemption from state and local levies, exemption from electricity duty, single window clearance under the State Laws etc. as provided in sub-Rule (5) of Rule 5 of the Special Economic Zone Rules, 2006. [Rule 4(5)]

• The State Government has to forward the proposal with its recommendations within 45 days from the date of receipt of such proposal to the Board of Approval (BOA) addressed to Deputy Secretary, (SEZ) Department of Commerce, Udyog Bhavan, New Delhi. [Rule 4 (1)]

• The applicant also has the option to submit the proposal in Form A directly to the Board of Approval addressed to Deputy Secretary, (SEZ) Department of Commerce, Udyog Bhavan, New Delhi. In such cases, the applicant shall have to obtain the concurrence of the State Government within 6 months from the date of such approval. [Proviso to Rule 4(1)]

• After approval by the Board, the Department of Commerce issues a Letter of Approval to the applicant for establishment of the SEZ (Rule 6)

• After receipt of the Letter of Approval and on submission of details of the land and a clarification from the concerned state government or its authorized agency stating that

developer has legal possession and irrevocable right, the Department of Commerce shall notify the area as an SEZ. (Rule 7 and 8)

• The applicant is required to submit details of the operations proposed to be undertaken in the SEZ so as to obtain authorization for the same from the BOA. Exemptions from central duties and taxes are extended only for the authorized operations.

• Procurement of goods for development of SEZ for authorized operations shall be approved by the Approval Committee at the zone level on the basis of which goods can be procured without payment of Customs duty and Excise Duty by the developer. (Rule 10)

• The applicant has to submit Bond cum Legal Undertaking in the Form-D[SEZ Rule 22(i)].The same shall be jointly accepted by Development Commissioner and by the Specified Officer.

What is a maximum area limit for multi-product Special Economic Zone?

The maximum area over which a multi-product Special Economic Zone can be set up is 5000 hectares. However, the Central government may consider on merit, the clubbing of contiguous existing notified Special Economic Zones notwithstanding that the total area of resultant Special Economic Zones exceeds 5000 hectares.

What is the minimum area requirement for establishment of Special Economic Zones?

The minimum area requirements stipulated for various categories of SEZs are:

| TYPE | AREA | AREA FOR SPECIAL STATES/UTs | MINIMUM BUILT-UP AREA. |

| Multi-product | 1000 hectares | 200 hectares | — |

| Multi services | 100 hectares | 100 hectares | — |

| Sector specific | 100 hectares | 50 hectares | — |

| Handicrafts | 10 hectares | 10 hectares | — |

| IT/ITES, Electronic Hardware | 10 hectares | 10 hectares | 1 Lakh sq.meter processing area. |

| Gems and Jewellery | 10 hectares | 10 hectares | 50,000 sq. meters processing area |

| Bio-tech, Non - Conventional energy including solar energy equipments/ cell | 10 hectares | 10 hectares | 40,000 sq. meters processing area |

| Non Conventional energy Excluding solar energy equipments/ cell | 10 hectares | 10 hectares | |

| FTWZ | 40 hectares | 40 hectares | 1 lakh sq.meters processing area. |

The Special States are Assam, Meghalaya, Nagaland, Arunachal Pradesh, Mizoram, Manipur, Tripura, Himachal Pradesh, Uttranchal, Sikkim, Jammu & Kashmir and Goa

Who can establish a Special Economic Zone?

A Special Economic Zone can be established by individual, whether resident in India or outside India, a Hindu undivided family, a co-operative society, a company, a firm, proprietary concern, or an association of persons or body of individuals, local authority or by the State Governments. (Section 3 of SEZ Act, 2005)

The Central Government does not intend to set up any new SEZs.

Will it be possible to supply to other units in SEZ?

YES. Inter Unit Sales are permitted as per the Policy. Buyer procuring from another unit pays in Foreign Exchange.

What are the provisions relating to External Commercial Borrowing (ECB) in SEZ ?

External commercial borrowings by units up to $ 500 million a year allowed without any maturity restrictions For details please see guidelines issued by RBI (F.No. 4(2)/2002-ECB, dated 15.9.2002).

recent news

-

Mihan problem will solve soon Sep 25, 2021

-

Now MIHAN will become dexterous Sep 25, 2021

-

State Advance Disaster Response Center in MIHAN Sep 25, 2021

-

Multi specialty hospital will construct in MIHAN Sep 25, 2021

-

Mihan is growing even after having trouble Sep 25, 2021

-

Small industry will also gets a plot in MIHAN Sep 25, 2021

-

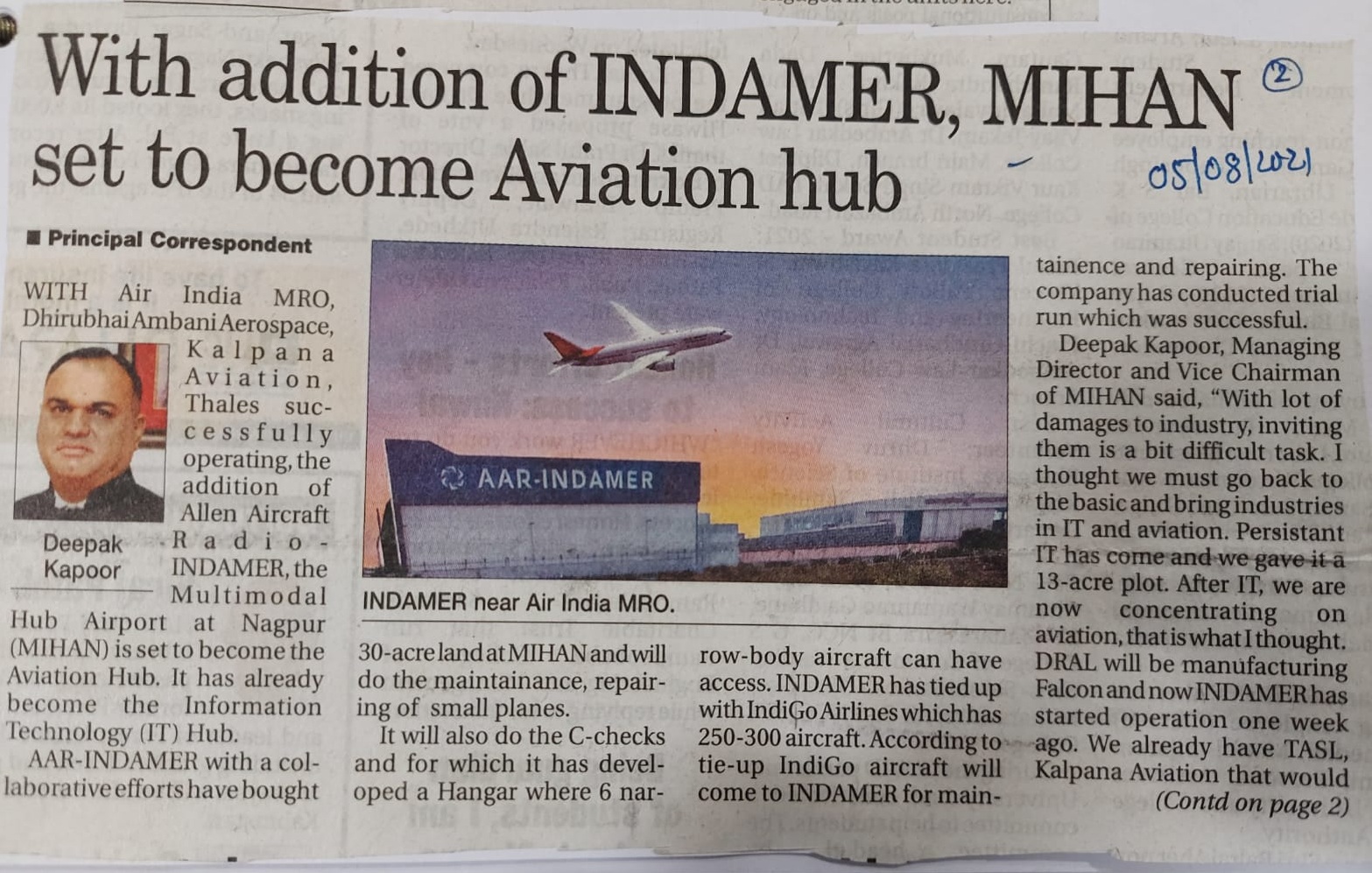

Second MRO in MIHAN-SEZ gets operational Sep 25, 2021

-

Kalpna saroj aviation reached in MIHAN Sep 25, 2021