Frequently Asked Questions

- Home

- Frequently Asked Questions

Routine examination of goods by customs in the EOU is common. Will the same practice continue at the SEZ?

Customs examination is to the bear minimum. SEZ units function on self certification basis.

What is the practical role of Development Commissioner?

Development Commissioner is the nodal officer for SEZs and help in resolution of problem, if any, faced by the units / developer.

If one buy goods from DTA should they require to pay State Sales Tax and Excise?

NO. State has exempted the sales from DTA to SEZ from local levies and taxes.

What about the Licenses for Imports?

No License is required for imports, including second hand machineries.

What are the special features if we come to the zone?

The units would be entitled for a package of Incentives and a simplified operating environment

Are SEZ's controlled by Government ?

In all SEZ's , the statutory functions are controlled by the Government. Government also controls the operation and maintenance function in the 7 Central Government controlled SEZs. In rest of the operation and maintenance are privatised.

Who monitor the functioning of the units in SEZ ?

Performance of the SEZ units monitored by a Unit Approval Committee consisting of Development Commissioner, Custom and representative of State Govt. on annual basis.

What are the facilities for Domestic suppliers to Special Economic Zone?

Supplies from Domestic Tariff Area (DTA) to SEZ to be treated as physical export. DTA supplier would be entitled to :

• Drawback/DEPB

• CST Exemption

• Exemption from State Levies

• Discharge of EP if any on the suppliers

• Income Tax benefit as applicable to physical export under section 80 HHC of the Income Tax Act.

Whether SEZs have been exempted from Labour laws?

Normal Labour Laws are applicable to SEZs, which are enforced by the respective state Governments. The state Government have been requested to simplify the procedures/returns and for introduction of a single window clearance mechanism by delegating appropriate powers to Development Commissioners of SEZs.

What are the incentive/facilities available for SEZ units?

Following incentive/ facilities to SEZ enterprises:

Customs and Excise :

• SEZ units may import or procure from the domestic sources, duty free, all their requirements of capital goods, raw materials, consumables, spares, packing materials, office equipment, DG sets etc. for implementation of their project in the Zone without any licence or specific approval.

• Duty free import/domestic procurement of goods for setting up of SEZ units.

• Goods imported/procured locally duty free could be utilised over the approval period of 5 years.

• Domestic sales by SEZ units will now be exempt from SAD.

• Domestic sale of finished products, by-products on payment of applicable Custom duty.

• Domestic sale rejects and waste and scrap on payment of applicable Custom duty on the transaction value .

Income tax

• Physical export benefit

• 100% IT exemption (10A) for first 5 years and 50% for 2 years thereafter.

• Reinvestment allowance to the extend of 50% of ploughed back profits

• Carry forward of losses

Foreign Direct Investment :

• 100% foreign direct investment is under the automatic route is allowed in manufacturing sector in SEZ units except arms and ammunition, explosive, atomic substance, narcotics and hazardous chemicals, distillation and brewing of alcoholic drinks and cigarettes , cigars and manufactured tobacco substitutes.

• No cap on foreign investments for SSI reserved items.

Banking / Insurance/External Commercial Borrowings

• Setting up Off-shore Banking Units allowed in SEZs.

OBU's allowed 100% Income Tax exemption on profit for 3 years and 50 % for next two years.

• External commercial borrowings by units up to $ 500 million a year allowed without any maturity restrictions.

• Freedom to bring in export proceeds without any time limit.

• Flexibility to keep 100% of export proceeds in EEFC account. Freedom to make overseas investment from it.

• Commodity hedging permitted.

• Exemption from interest rate surcharge on import finance.

• SEZ units allowed to 'write-off' unrealized export bills.

Central Sales Tax Act :

• Exemption to sales made from Domestic Tariff Area to SEZ units.

Income Tax Act:

Service Tax:

• Exemption from Service Tax to SEZ units

Environment :

• SEZs permitted to have non-polluting industries in IT and facilities like golf courses, desalination plants, hotels and non-polluting service industries in the Coastal Regulation Zone area

• Exemption from public hearing under Environment Impact Assessment Notification

Companies Act :

• Enhanced limit of Rs. 2.4 crores per annum allowed for managerial remuneration

• Agreement to opening of Regional office of Registrar of Companies in SEZs.

• Exemption from requirement of domicile in India for 12 months prior to appointment as Director.

Drugs and Cosmetics :

• Exemption from port restriction under Drugs & Cosmetics Rules.

Sub-Contracting/Contract Farming

• SEZ units may sub-contract part of production or production process through units in the Domestic Traiff Area or through

other EOU/SEZ units

• SEZ units may also sub-contract part of their production process abroad.

• Agriculture/Horticulture processing SEZ units allowed to provide inputs and equipments to contract farmers in DTA to promote production of goods as per the requirement of importing countries.

recent news

-

Mihan is growing even after having trouble Sep 25, 2021

-

Kalpna saroj aviation reached in MIHAN Sep 25, 2021

-

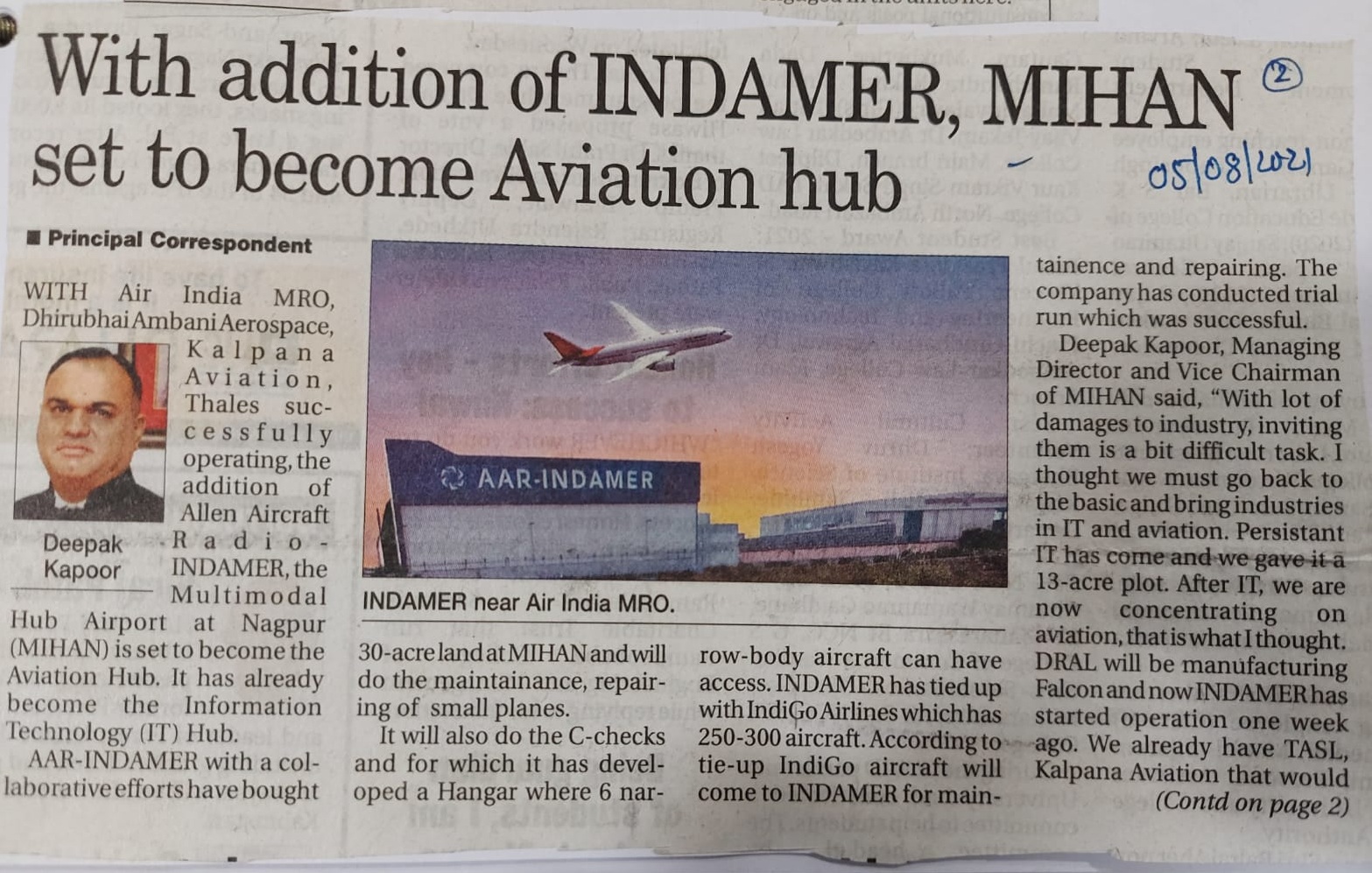

Now MIHAN will become dexterous Sep 25, 2021

-

Multi specialty hospital will construct in MIHAN Sep 25, 2021

-

Second MRO in MIHAN-SEZ gets operational Sep 25, 2021

-

Small industry will also gets a plot in MIHAN Sep 25, 2021

-

Units at MIHAN-SEZ record export growth amid Covid Sep 25, 2021

-

State Advance Disaster Response Center in MIHAN Sep 25, 2021